EUA sell-off is a natural reflection of economic recession

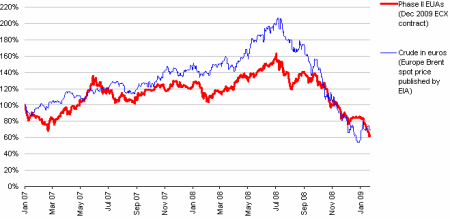

Carbon prices have been falling recently. Since July 2008, EUAs have lost over 60% of their value and are one of the worst performing commodities in 2009. The chart below (click to expand) shows the EUA price indexed to January 2007. I have also included the oil price, which has been converted from dollars to euros, for comparison.

As you can see, carbon has largely followed oil. The main mechanism at work is that oil prices drive gas prices, which in turn determine the cost of switching energy generation from coal to gas. Burning gas produces less carbon dioxide per unit of energy than coal, so demand for EUAs goes down when gas gets cheaper. Levels of industrial production also drive both markets, of course, which leads them to correlate.

But in the past couple of weeks oil and carbon seem to have ‘decoupled’ (as you can see from the sharp drop-off in EUAs in January, while crude has recovered from a low at the end of last year). A new factor seems to be at play: industrial companies in distress selling their stockpile of EUAs, now surplus as their output shrinks, on the spot market to raise funds they cannot find in the credit market.

Many environmental commentators and journalists are saying that this demonstrates an inherent weakness in cap-and-trade. An article in Reuters last week said that:

companies from some of the European Union’s most polluting industries are now raising funds on the carbon market to help them weather the credit crisis.

That has raised some uncomfortable questions about a scheme meant to fight climate change rather than subsidize companies during a downturn.

“This was not designed as a scheme to give corporates cheap short-term funding options in the face of a credit crunch meltdown where banks are not lending,” said Mark Lewis, Deutsche Bank carbon analyst. “But that appears to be what’s happening.”

The first thing to get straight is that the through the EU ETS, the members states are transferring a liability to the regulated industries, not an asset. EUAs only have a value if there is a cost to complying with the emissions cap they represent. The EUA ‘windfall’ in this situation is better described as a reduced burden of compliance across the whole market, which pushes some companies long while most remain short. There must still be buyers out there no ‘windfall’ would be possible.

This new factor of spot sell-offs is really just a particularly rough piece of volatility reflecting rapid changes in expected demand over the next few years.

Given that EUAs can be banked into Phase III of the EU ETS (which will run from 2013– 2020), it is unlikely that the recession will hit manufacturing and energy so severely that the carbon price will collapse in the way it did in 2006. If this were to happen, does anyone really think a carbon tax, which would continue to brake output regardless, would fare better politically than cap-and-trade?

February 3, 2009 at 10:25 pm

Interesting read. I think people forget that the ETS is just a tool to curb emissions used when otherwise we would just carry on growing them. Clearly there are times when fuel pricing and demand will naturally lower emissions and the ETS has little effect. The bottom line is that emissions are being lowered and the ETS will continue to reduce emissions when demand and gas prices pick up and we switch back to coal.

CER substitution for EUA’s is also diluting the value of EUA’s, this may self correct as we see the low prices start to make new projects look uneconomic and the CER market drys up increasing the demand for EUA’s

August 23, 2009 at 6:06 pm

[…] carbon still following oil? In January I looked at European carbon prices to show how they were reacting to the economic recession. Today I had another look at these two […]