I drafted this article a few months ago for Carbon Retirement‘s newsletter, but simliar ‘peak oil primer’ articles were published around the same time by a couple of big publications and I decided not to publish it. In hindsight, I think this article is a bit more factual and have decided to post it here.

Through the Twentieth Century, we continuously increased the rate at which we drilled oil, but cheap, easily accessible oil may now be running out. This article looks at some of the debates around ‘peak oil’ and starts to explore how it could be relevant to people and businesses.

What is peak oil?

Peak oil is something that happens in all oil fields. The light, good quality oil rises to the top. It is cheap to extract and easy to refine. As the field empties, the remaining oil is thicker and stickier and more difficult to extract and refine. The finished product becomes more expensive to produce and production tails off.

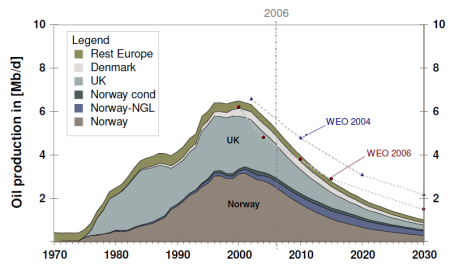

If you add together fields that are at different stages in their lifecycles, you get a similar pattern, suggesting that peak oil also applies to regions. Here in Europe, for example, we are already well past the peak.

Oil production in OECD Europe

Source: Energy Watch Group 2007 - http://www.energywatchgroup.org/fileadmin/global/pdf/EWG_Oilreport_10-2007.pdf

What is less certain is whether oil production on a global level is going to peak any time soon, and how peak oil will affect economies, companies and communities.

What evidence is there for global peak oil?

There is agreement on one thing: there is still a lot of oil in the ground. The question is how much of it is accessible at a price we are prepared to pay. Much of it is deposited in places that are difficult to reach, or is controlled by unpredictable or hostile governments.

One important piece of evidence is the rate of new discoveries. A pattern is noticeable in countries where production has already peaked: the rate of new discoveries peaks a few decades before production peaks. In the US, discoveries peaked in the 1930s and production peaked in 1971. In the UK, discoveries peaked in 1975 and production in 1999. Global discoveries peaked in 1964.

A second piece of evidence concerns the recent oil price shock. Higher prices should stimulate more production if there are opportunities to develop new oil fields, but while the oil price increased from around $50 per barrel in early 2007 to around $145 in mid-2008, production hardly changed.

Thirdly, the average amount of energy required on average to get oil out the ground is increasing. According to Simon Ratcliffe of the Association for the Studies of Peak Oil and Gas, in the early Twentieth Century one unit of energy was required to produce oil containing 100 units of energy. In the 1970s, this ratio had declined to around 25:1. Today, some fields are only achieving 4:1.

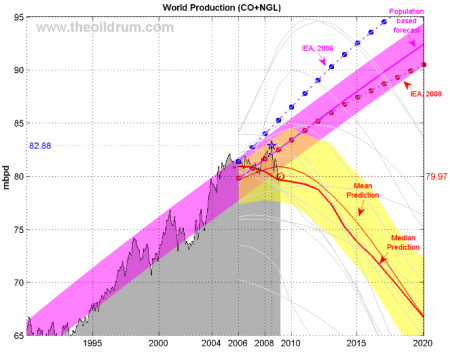

There are many predictions of when global peak oil will occur. Some say it is happening now or even happened in the past few years. Others believe that production will continue to increase for several decades. The chart below shows a range of forecasts. The International Energy Agency (a forum for industrialised countries) has some of the most optimistic views.

Global oil production forecasts

Mbpd = million barrels per day CO + NGL = crude oil and natural gas liquids Source: The Oil Drum: http://www.theoildrum.com/node/5521

In August 2009 the IEA’s latest research showed that oil production is likely to be lower that previously thought. The forum’s chief economist told The Independent:

One day we will run out of oil … and we have to prepare ourselves for that day. The earlier we start, the better, because all of our economic and social system is based on oil, so to change from that will take a lot of time and a lot of money and we should take this issue very seriously.

The oil and gas companies are often optimistic about oil production. BP, a company that is investing in difficult oil deposits like tar sands in North America, believes that more sophisticated extraction technology will allow affordable oil to continue flowing for several decades. In a speech earlier this year (pdf), David Eyton, BP’s Head of Research and Technology, said:

There has been much debate about if and when we will reach ‘peak oil’. BP’s viewpoint is that there is no shortage of fossil fuels: we estimate that the world has already demonstrated the commercial viability of around 40 more years of conventional oil resources, 60 years of gas and 130 of coal at current consumption rates. Technology can extend all of these timelines well into the next century, in particular through the development of more unconventional resources. In our view, the more pressing challenge in the next decade is likely to be environmental — and more about the ‘peak carbon carrying capacity’ of our atmosphere than the availability of fossil fuels.

Shell’s view is more conservative, but still shows a belief that technology will allow new sources of oil to be gainfully exploited (from the Peak Oil Task Force report):

The global supply of oil will flatten by 2015, in Shell’s view, and if the oil industry globally is to maintain hydrocarbons supply on this plateau, very heavy investment will be required in ultradeep water, pre-salt layers, tight gas, coal-bed methane, in the Canadian tar sands and other areas of unconventional oil production

Until we have clearly passed the peak there will be a range of views, and the oil and gas industry is likely to be at the optimistic end. Several people we spoke to in preparation of this article, including some ex-employees of oil and gas companies, felt that companies like Shell and BP tend to be optimistic about their future production to protect their share prices.

How might society be impacted?

A reduced oil supply will have a particular impact on transport because 99% of transport fuel is petroleum (BERR 2008) – a product of oil. Food will also be affected because fertilisers are made from oil and the global food supply chain relies on transport for moving food between continents.

Let’s think about what could go wrong. Trade will reduce as transport becomes more expensive, and countries and local communities will be forced to diversify to produce food and energy. With less total energy going into the global economy and less labour specialisation, economies will shrink.

More competition for resources will lead to military occupation of oil rich areas. Politics will become nationally focused as countries seek to secure their energy and food supplies.

People differ in their view of the severity of these changes. Nathan Hagens, an energy researcher at the University of Vermont, identified four views of our future:

- The ‘renewable energy’ contingent, who generally subscribe to the belief that solar based flows will eventually replace fossil fuels in a somewhat seamless transition and that Peak Oil is probably a good thing with respect to the environment;

- The energy technologists, who believe that even in face of near term peak, that better drilling, seismic, and recovery techniques combined with increases in unconventional fuels will keep us roughly on a business as usual path. (BP falls into this group);

- The End of Growth group – who think we have overshot resource limits (not just energy) and must generally powerdown to some cocktail of both more sustainable means and aspirations; and

- The Dieoff Crowd – that some large proportion (possibly all) of humankind will perish due to biological tenets based on fact that we are akin to a plague species, our rapaciousness trumps our ingenuity and ability to plan for future…essentially humans are not smarter than yeast.

In some countries, local communities have begun to organise to increase their resilience to these changes. These movements are called Transition Towns. They seek to reduce their energy use, grow food locally and improve community links. In short – to break their reliance on global energy systems.

How is peak oil relevant to a business manager?

It’s tricky for a manager of a company that is not directly involved in energy to engage closely with peak oil. The debates are complex and technical, with different points of view. As a result, most people who think about peak oil are geologists or involved in the oil and gas industry, and sustainability managers are not usually engaged with the issue. Peak oil is in a similar place to climate change ten years ago – which was mainly a concern for campaigners and atmosphere scientists.

However, a decline in oil supply would have a big impact on every economic sector. Oliver Dudok van Heel, a sustainability expert, believes that “some carbon intensive businesses will not survive. If a business model is based on liquid fossil fuels being available at a low price, they will have to change the way they operate. Overall, economies are likely to grow less and possibly shrink.”

As a business manager, you need to think about the resilience of your business model. Here are five questions to start you off.

- How sensitive is your business to higher energy prices? What would be the impact on profitability of a long term increase in the price of oil?

- How reliant on oil are your customers? Do their businesses depend on transport, for example? If their businesses suffer, yours will suffer too.

- Are there commercial opportunities in a more limited energy scenario? Even if the economy shrinks, some businesses will be successful if they can help local communities to diversify and meet their immediate needs.

- Are there ways that your business can support local food and energy production?

- What are other organisations in your sector doing about peak oil?