I just read the new report on carbon trading (pdf) from Friends of the Earth. Given the charity’s stance on anything related to carbon trading, the critical approach is unsurprising. The report makes some good points, but also makes some points that don’t seem well thought out. This is a shame because the charity could achieve much more by taking a reasoned position in the debate and focusing on the things that need changing.

One of my gripes is that the report contains some rash statements, like:

The EU ETS scheme has clearly failed to provide adequate incentives for European firms to reduce their emissions in Phase I; Phase II is performing poorly and is likely to fail.

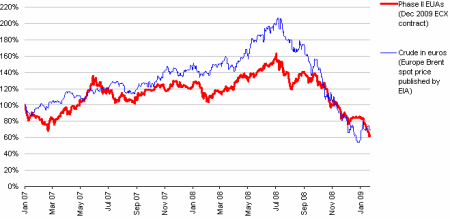

Is it? Last time I checked it was doing OK! Or:

The complexity of the carbon markets, and the involvement of financial speculators and complex financial products, carries a risk that carbon trading will develop into a speculative commodity bubble that could provoke a global financial failure similar in scale and nature to that brought about by the recent subprime mortgage crisis.

That’s not a good comparison. There is a lot of derivative trading in the EU ETS but we know exactly what the underlying asset is. The derivatives are simply tools to make trading smoother. The idea that carbon markets are a ponzi scheme run by speculators runs through the report, and some errors are made, including that most carbon credits are held by speculators (they aren’t; most credits are held by statutory market participants).

And the environmental economics get a bit shaky with the argument that cap and trade actually ‘locks in’ high emissions:

Polluters have an incentive to make extra emission reductions under emissions trading so that they can sell credits, therefore, emissions trading stimulates innovation. This model accurately explains the situation of sellers of credits. […But it ignores the buyers…] Carbon trading makes lower-cost credits available to these firms as an alternative to the higher-cost investments that they would otherwise have to make. Hence trading removes any incentive that they have for technological innovation.

This would be better explained as “cap and trade makes equally valuable emission reductions for less money”.

I do, however, agree with FoE’s stance on offsetting. The report says:

developed countries are using the prospect of increased carbon market finance to hide from their commitments under the United Nations Framework Convention on Climate Change (UNFCCC) to provide new and additional sources of finance to developing countries. Carbon market finance comes from offsetting developed-country emissions cuts which should be additional. Counting it towards the financial commitments of developed countries is double counting.

This is right. And the report makes a generally fair rehearsal of all the usual issues with offsetting and the CDM.

If the parties to the UNFCCC can turn the screw on carbon markets, by (a) using the cap to demonstrate greater commitment to more ambitious reductions and (b) cutting out offsetting, then carbon markets like the EU ETS can be an effective central tool in mitigation. There is no reason why cap and trade should exclude direct support for low carbon technologies where governments feel help is needed.

It’s not practical to ask the UNFCCC to throw out carbon markets, and I would like to see FoE take only its reasonable points to the negotiations.